Disability Insurance and Long Term Care

Disability InsuranceLong Term Care

Disability Insurance

If you were disabled and unable to work as a result of an accident or illness, what would you and your family do for income?

Disability income insurance, which complements health insurance, can replace lost income. Forty-three percent of all people age 40 will have a long-term (lasting 90 days or more) disability event by age 65.

There are four basic disability programs designed to replace income:

- Employer-paid disability insurance

Most employers provide some short-term sick leave. Many larger employers provide long-term disability coverage as well. The benefits can last from five years to age 65, and in some cases extended for life. This is a great benefit if it is available. Two disadvantages are that benefits are usually limited to 60 percent of your pre-disability salary and if you change jobs you generally can’t take this type of disability coverage with you. - Social Security disability benefits

This can be paid to workers whose disability is expected to last at least 12 months and is so severe that no gainful employment can be performed. Two major disadvantages are that it is more difficult to qualify for a claim upon the initial disability, and the length of time the benefits are paid is often cut short. - Special Circumstances

Other limited replacement income is available for workers under some circumstances from workers compensation (if the injury or illness is job-related), auto insurance (if disability results from an auto accident) and the Department of Veterans Affairs. - Individual disability income insurance

For most workers, even those with some employer-paid coverage, an individual disability income policy is the best way to ensure adequate income in the event of disability. When you buy a private disability income policy, you can expect the benefits to replace from 50% to 70% of your pre-disability income. Insurers won’t replace all your income because they want you to have an incentive to return to work. However, when you pay the premiums yourself, disability benefits are not taxed. (Conversely, benefits from employer-paid policies are subject to income tax.). In addition, there are several other advantages to owning an individual disability income policy:

- Noncancelable- means the policy cannot be canceled by the insurance company, except for nonpayment of premiums. This gives you the right to renew the policy every year without an increase in the premium or a reduction in benefits.

- Guaranteed renewable- gives you the right to renew the policy with the same benefits and not have the policy canceled by the company. However, your insurer has the right to increase your premiums as long as it does so for all other policyholders in the same rating class as you.

- Additional purchase options - Your insurance company gives you the right to buy additional insurance at a later time.

- Coordination of benefits - The amount of benefits you receive from your insurance company is dependent on other benefits you receive because of your disability. Your policy specifies a target amount you will receive from all the policies combine d, so this policy will make up the difference not paid by other policies.

- Cost of living adjustment (COLA) - The COLA increases your disability benefits over time based on the increased cost of living measured by the Consumer Price Index. You will pay a higher premium if you select the COLA.

- Residual or partial disability rider - This provision allows you to return to work part-time, collect part of your salary and receive a partial disability payment if you are still partially disabled.

- Return of premium - This provision requires the insurance company to refund part of your premium if no claims are made for a specific period of time declared in the policy.

- Waiver of premium provision - This clause means that you do not have to pay premiums on the policy after your disability begins and you are receiving monthly benefits.

Of course, the drawback to having an individual disability income insurance policy is that you must pay your own premiums. If doing so is cost prohibitive, you can reduce your premiums by:

- Electing a longer waiting period before benefits begin - If you have enough resources to cover expenses during the first three to six months of disability, your premiums will be lower than with coverage that starts after 30 days.

- Electing a shorter benefit period - In most cases, benefits are payable to age 65—the age at which you would normally retire— However, as an alternative, you could choose a benefit period of two-to-five years, which would reduce your premiums significantly. However, this would also mean that in the event of a long term disability, you could be without coverage when you need it most. Disability of long duration poses the greatest financial hardship.

Long Term Care

Because of old age, mental or physical illness, or injury, some people find themselves in need of help with eating, bathing, dressing, toileting or continence, and/or transferring (e.g., getting out of a chair or out of bed). These six actions are called Activities of Daily Living–sometimes referred to as ADLs. In general, if you can’t do two or more of these activities, or if you have a cognitive impairment, you are said to need “long-term care.”

Long-term care isn’t a very helpful name for this type of situation because, for one thing, it might not last for a long time. Some people who need ADL services might need them only for a few months or less.

Many people think that long-term care is provided exclusively in a nursing home. It can be, but it can also be provided in an adult day care center, an assisted living facility, or at home.

Assistance with ADLs, called “custodial care,” may be provided in the same place as (and therefore is sometimes confused with) “skilled care.” Skilled care means medical, nursing, or rehabilitative services, including help taking medicine, undergoing testing (e.g. blood pressure), or other similar services. This distinction is important because Medicare and most private health insurance pays only for skilled care–not custodial care.

Will I need long-term care?

If you’re under 55, it’s unlikely. Even over 55, only a small percentage of the population will need long-term care before they are in their 70s or 80s.

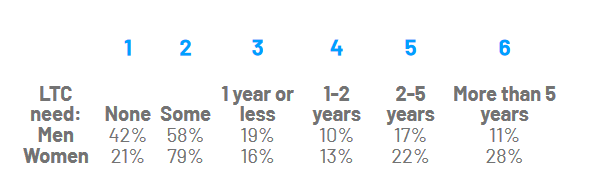

However, according to research published in the journal Inquiry by Kemper, Komisar, and Alecxih, most people who turn 65 in 2005 will, in their lifetime, need some level of long-term care.

Columns 3 through 6 show the distribution of people in column 2. Note that this study defines LTC need as having one or more ADL limitations, four IADL limitations, or using formal LTC services other than post-acute care under Medicare. As such, it indicates somewhat greater usage of LTC services than most long-term care insurance policies would pay for.

Recent trends suggest that 50 percent or more of the people who might have gone into a nursing home for long-term care will in the future go into an assisted living facility. Assisted living facilities generally cost less than nursing homes. For example, in mid-2005, a MetLife Mature Market Institute survey found a national average daily cost of assisted living facilities of $100, with a range from $55 to $155 across the U.S.

The good news is that people are living healthier longer—that, in other words, the need for long-term care is diminishing and, when it occurs, the onset of need for long-term care is, on average, occurring later and later in life and starting closer to death (so that future periods of long-term care needs may be shorter than at present). In part, this is due to the adoption of better prevention strategies and better medical practices. Even so, if you do need long-term care services, they can be expensive.

Should I buy long-term care insurance?

If you need long-term care services and have to pay to obtain them, what financial resources could you call on? Do you have enough to pay for four or more years in a nursing home, an assisted living facility, or home health care?

If you’re over 65, don’t rely on Medicare or private health insurance. Medicare doesn’t pay for custodial care, and private health insurance rarely pays any of the cost of long-term care.

If you expect to have very little money when you need long-term care services, you might qualify for Medicaid, a government program that pays the medical and long-term care expenses of poor people. If you expect to be in that situation, you probably shouldn’t buy long-term care insurance, because your state’s Medicaid program will pay your long-term care expenses. Buying long-term care insurance would only save the state—not you—money. The exception is if you live in California, Connecticut, Indiana, or New York, states that have a Partnership for Long-Term Care program. For residents of these four states, buying long-term care insurance does offer an additional benefit.

If you expect to have a lot of money when you need long-term care services, you also probably shouldn’t buy long-term care insurance. Instead, you should plan to pay for the care “out of pocket”—that is, as a regular expense. Some financial advisors suggest that if your net worth is in the $1.5 million range, not including the value of your home, you could safely skip buying long-term care insurance and treat long-term care expenses, if they arise, as you do your other bills.

If you fall in-between these two categories, owning long-term care insurance, like all other insurance coverages, offers peace-of-mind benefits as well as financial ones. For example, a recent survey of people age 50 and over asked how confident they were that they could pay for long-term care services if they needed them. Among those with long-term care policies, 52 percent said they were very confident and another 40 percent said they were somewhat confident. Among those who didn’t own a long-term care policy, only 8 percent were very confident and only 27 percent were somewhat confident.

Regardless of your age, you shouldn’t ignore the topic of long-term care insurance because:

- You might not be able to buy long-term care insurance if you wait too long. Wakely Consulting Group, an actuarial firm, studied applicants for long-term care insurance; the findings: 11 percent of applicants in their 50s, 19 percent in their 60s and 43 percent in their 70s were rejected.

- A Milliman & Robertson actuary estimated that 15 to 25 percent of the over-65 age group are uninsurable for long-term care.

- A report from the Henry J. Kaiser Foundation indicates that over five million people ages 18-64 need some type of long-term care.

- The latest data from the National Center for Health Statistics reported that roughly 160,000 of the people living in nursing homes were under age 65 (nearly 10 percent of the total). Of those receiving home health care services, roughly 400,000 were under 65 (about 30 percent of the total).

So, unless you have so little money that you will qualify for Medicaid, or so much money that you can pay the bills out of your own pocket, you should consider buying long-term care insurance.

What’s the best age to buy long-term care insurance?

In general, it's a good idea to buy long-term care insurance before you’re 60, for two reasons:

- The younger you are, the less likely it is that you’ll be rejected when you apply for the policy. If you apply in your 50s, there’s a one in ten chance you’ll be rejected. If you apply in your 60s, the chance of rejection is two in ten. If you apply in your 70s, the chance of rejection is four in ten.

- The younger you are, the lower the premium will be for a given set of benefits and features. Once the premium is set, it stays at that amount for the life of the policy, unless the claims for the group of people who have bought that type of policy require that rates for the group be raised.

- The inability to perform two or three specific "activities of daily living" without help. These include bathing, dressing, eating, toileting and "transferring" or being able to move from place to place or between a bed and a chair.

- Cognitive impairment. Most policies cover stroke and Alzheimer’s and Parkinson's disease, but other forms of mental incapacity may be excluded.

- Medical necessity, or certification by a doctor that long-term care is necessary.

- 1=7 Elimination period. Under some policies, if the insured has qualifying long-term care expenses on one day during a seven-day period, he or she will be credited with having satisfied seven days toward the elimination period. This type of provision reflects the way home care is often delivered—some days by professionals and some days by family members.

- Guaranteed renewable policies must be renewed by the insurance company, although premiums can go up if they are increased for an entire class of policyholders.

- Waiver of premium, so that no further premiums are due once you start to receive benefits.

- Third-party notification, so that a relative, friend or professional adviser will be notified if you forget to pay a premium.

- Nonforfeiture benefits keep a lesser amount of insurance in force if you let the policy lapse. This provision is required by some states.

- Restoration of benefits, which ensures that maximum benefits are put back in place if you receive benefits for a time, then recover and go for a specified period (typically six months) without receiving benefits.

- 1. Find out if long-term care benefits are available through a group policy from your employer. Employers might subsidize the cost, lowering what you must pay.

- 2. Check whether you can add long-term care benefits as a rider on an existing life insurance or annuity policy. These “combination” arrangements can save because the insurance company gains operational savings that it can pass along to you.

- 3. Buy a policy with the longest waiting period you can afford. For example, choosing a 90-day period instead of a 30-day period can cut the premium by 30%. However, if you do need long-term care services, you should save some money to pay these costs until the waiting period ends.

- 4. If both spouses of a married couple are considering buying long-term care policies, look into buying one joint policy for both of you. Such a policy pays when either one needs care and can pay for both, if necessary, up to its benefit limits.

- 5. If you’re still looking to trim the premium further, consider buying a policy that will pay most, but not all, of the average nursing home costs in your area. For example, if a nursing home room now costs $120 per day, buy a policy that pays $100 per day. However, be sure to buy an inflation-protection provision.

- 6. Check with several companies and agents, comparing both benefits and costs. As with other types of insurance (and many other purchases), comparison shopping can save you money. Just be sure you’re comparing policies with similar provisions and companies with comparable financial strength and service records.

- Assume you’re 55 and won’t need long-term care for 30 years, when you’re 85.

- Assume you save $2,000 per year, that you invest the savings, and that your investment grows at 5 percent per year, net after taxes. After 30 years, your savings will have grown to $139,500.

- Assume today’s monthly cost of nursing home care grows, due to inflation, by 5 percent per year, from $7,000 per month now to $28,800 per month in the future.

- At that time—that is, when you’re 85—if all these assumptions come true, your savings would be able to pay for less than three months of nursing home care; if you need more money—say, because the cost of services for long-term care grew faster than 5 percent per year or your investments earned less than 5 percent net after taxes—you’d have to liquidate other assets that you hadn’t planned to liquidate, if you have them.

- Nursing home costs inflate at 3 percent per year for 30 years: monthly cost of $16,500

- Earn 6 percent per year net after taxes on saving $1,000 per year: accumulate $83,800

- Save $1,200 per year at 5 percent net after taxes: accumulate $83,700

How much does long-term care cost?

The cost of long-term care depends on three factors – the general level of charges in your part of the country, the specific expense rate for the services you need, and how long the need for care lasts.

In August 2005, the average cost for a month in a semiprivate room in a nursing home ranged from a low of $3,000 in Shreveport, LA, to a high of $9,250 in New York City, according to a survey by the MetLife Mature Market Institute (MMI). A year-long stay translates to $36,850 in Shreveport and $112,400 in New York City.

The MMI also surveyed covered costs of Assisted Living and Home Health Care. In August 2005, the lowest average monthly base rate for an Assisted Living facility was $1,650 in Jackson, MS area and the highest was $4,300 in the Stamford, CT. area.

In August 2005, the lowest average hourly rate for a home health aide was $12 in Shreveport, and the highest was $23 in Rochester, MN. If you need a home health aide around-the-clock, these rates translate to a daily rate ranging from $288 to $552, or a monthly rate of $8,640 to $16,550.

Finally, don’t forget that long-term care costs, like most health care costs, are rising faster than the general rate of inflation. The bottom line? A four-year-or-longer stay in a nursing home could cost $200,000 to $450,000 or more (in today’s dollars). If you can’t pay this out of your own pocket and aren’t poor enough to qualify for Medicaid, you should consider buying long-term care insurance.

Where may care occur?

The best policies pay for care in a nursing home, assisted living facility, or at home. Benefits are typically expressed in daily amounts, with a lifetime maximum. Some policies pay half as much per day for at-home care as for nursing home care. Others pay the same amount, or have a "pool of benefits" that can be used as needed.

Under what conditions will the policy begin paying benefits?

The policy should state the various conditions that must be met:

What events must occur before the policy begins paying benefits?

Some older policies require a hospital stay of at least three days before benefits can be paid. This requirement is very restrictive; you should avoid it. Also, most policies have a “waiting period” or "elimination" period. This is a period that begins when you first need long-term care and lasts as long as the policy provides. During the waiting period, the policy will not pay benefits. If you recover before the waiting period ends, the policy doesn’t pay for expenses you incur during the waiting period. The policy pays only for expenses that occur after the waiting period is over, if you continue to need care. In general, the longer the waiting period, the lower the premium for the long-term care policy.

How long will benefits last?

A benefit period may range from two years to lifetime. You can keep premiums down by electing coverage for three to four years—longer than the average nursing home stay—instead of lifetime.

Indemnity vs. Reimbursement

Most long-term care policies pay on a reimbursement (or expense-incurred) basis, up to the policy limits. In other words, if you have a $150 per day benefit but spend only $130 per day for a home long-term care provider, the policy will pay only $130. The “extra” $20 each day will, in some policies, go into a “pool” of unused funds that can be used to extend the length of time for which the policy will pay benefits. Other policies pay on an indemnity basis. Using the same example as above, an indemnity policy would pay $150 per day as long as the insured needs and receives long-term care services, regardless of the actual outlay.

Inflation protection

Inflation protection is an important feature, especially if you are under 65, when you buy benefits that you may not use for 20 years or more. A good inflation provision compounds benefits at 5 percent a year. Without inflation protection, even 3 percent annual inflation will, over 24 years, reduce the purchasing power of a $150 daily benefit to the equivalent of $75.

Six other important policy provisions

How can I save on long-term care insurance?

The tips below will help you save money wisely, but don’t rely on price alone.

MOST IMPORTANT: Because you may not collect for decades to come, be sure to buy from a company that has been around for some time and is financially stable. You may want to look up, from an independent rating agency, the financial strength ratings of a company you're considering.

GENERAL GUIDELINE: Keep the premium for your long-term care insurance policy to 7 percent of your income, or less. For example, if your monthly income is $4,000, the long-term care insurance premium should not be more than $280 per month. (This is what the National Association of Insurance Commissioners recommends in its Model Regulation for Long-Term Care Insurance.) Another expert advises that the income to use in this calculation isn’t your current income, but your expected income in retirement, since that’s the income from which you’ll be paying premiums for most of the policy’s existence.

Other ways of saving:

Should I invest the amount I would pay in long-term care insurance premiums instead of buying long-term care insurance?

If you're under 55, you might think that, since the likelihood of long-term care outlays is many years in the future, you could invest the money you might otherwise spend for long-term care insurance premiums. That way, if you do need long-term care, you could just draw upon that investment, and if not, you’d have money for your heirs, for a charitable donation, or for your own needs.

But this strategy leaves you vulnerable if you need long-term care services in your late 50s, 60s, or early 70s. And it might also leave you vulnerable if you need these services for a long time, even if you don’t need assistance until you’re in your 80s. Here’s why:

It’s possible that you’ll save more than $1,000 per year, or earn more than 5 percent net after taxes, or that the cost of long-term-care services will rise more slowly than 5 percent per year, or that two or more of these things will happen. In that case, if you need long-term care services for the first time after age 85, you would be able to pay for more than the example above shows. Here are some indications of what results alternate assumptions would produce:

Of course, it’s possible that you’ll never need long-term care services, or that if you do need them, you’ll need them only for a month or two. In that case, a long-term care policy won’t help. For most other scenarios, it’s probably a prudent buy.

What are 'Partnership for Long-Term Care' programs?

Medicaid is a state-government-administered program that pays the medical and long-term care expenses of poor people. If you have more money than your state permits when you need long-term care services, your state’s Medicaid won’t pay for those services. You’ll have to spend your own money–including using up your assets–until you become poor enough to qualify.

But if you live in California, Connecticut, Indiana or New York and you participate in the state’s Partnership for Long-Term Care program, you can qualify for Medicaid without spending yourself into poverty. To participate in the Partnership, you must buy a long-term care insurance policy that contains at least the basic benefits required by the Partnership program.

What’s the benefit of participating in the Partnership?

If you live in California, Connecticut, or Indiana, for example, and you buy a policy under the program, live in the state while receiving long-term care services, and eceive and exhaust the benefits under the policy for long-term care services, you can apply for Medicaid benefits even though you haven’t sold and used your assets. Each dollar paid by the insurance company is a dollar of assets you can keep in addition to the minimums permitted by your state’s Medicaid rules.

For example, suppose the long-term care policy has paid $50,000 in benefits; in that case, you can keep $50,000 in investments or savings and still qualify for Medicaid. Without a Partnership long-term care policy, you’d probably have to spend virtually all of that $50,000 (this is called spending down) before you became eligible for Medicaid to pay your long-term care bills. However, even under the Partnership program, although you get to keep your assets, you might still have to use part of your income to pay long-term care expenses.

Connecticut and Indiana have a reciprocity agreement, so that if you buy a policy under one state’s Partnership program and move to the other state, you can obtain the benefits of the other state’s partnership program.

Each state’s program is different, so be sure to learn the details of your state’s Partnership program before buying a long-term care policy.

In California, for example, the basic benefits include the following:

- Interchangeable benefits that can be switched between nursing home care and home care, or a combination of the two.

- A deductible that must be met only once in your lifetime.

- Inflation protection to insure that benefits keep pace with the rising cost of care.

- Waiver of premiums while you are receiving benefits in a nursing home or residential care facility.

Care coordination to assist you in planning and obtaining the services you want and need.

Under the California Partnership program, two types of policies are available–one that covers only benefits delivered in a nursing home or residential care facility, and one that covers comprehensively (at home, in a community facility, in a residential care facility, or in a nursing home).